How To Record A New Mortgage In Accounting . see some of the journal entries below to understand how journal entries of accounting for mortgage payables are. when recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash received (plus any outstanding mortgage). where fixed assets, such as a building, are purchased with the use of a mortgage, the journal entry to properly. These costs are recorded as a debit, together with the final cash amount received and the mortgage relieved. this would depend on your accounting standard you want to follow, but generally it is capitalized. Where your software or bookkeeping system. the account mortgage loan payable contains the principal amount owed on a mortgage loan. in year 1, i would record the following je: a loan journal entry can be recorded in different ways in bookkeeping software, here are three of them:

from www.e-bas.com.au

when recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash received (plus any outstanding mortgage). Where your software or bookkeeping system. see some of the journal entries below to understand how journal entries of accounting for mortgage payables are. where fixed assets, such as a building, are purchased with the use of a mortgage, the journal entry to properly. in year 1, i would record the following je: this would depend on your accounting standard you want to follow, but generally it is capitalized. These costs are recorded as a debit, together with the final cash amount received and the mortgage relieved. the account mortgage loan payable contains the principal amount owed on a mortgage loan. a loan journal entry can be recorded in different ways in bookkeeping software, here are three of them:

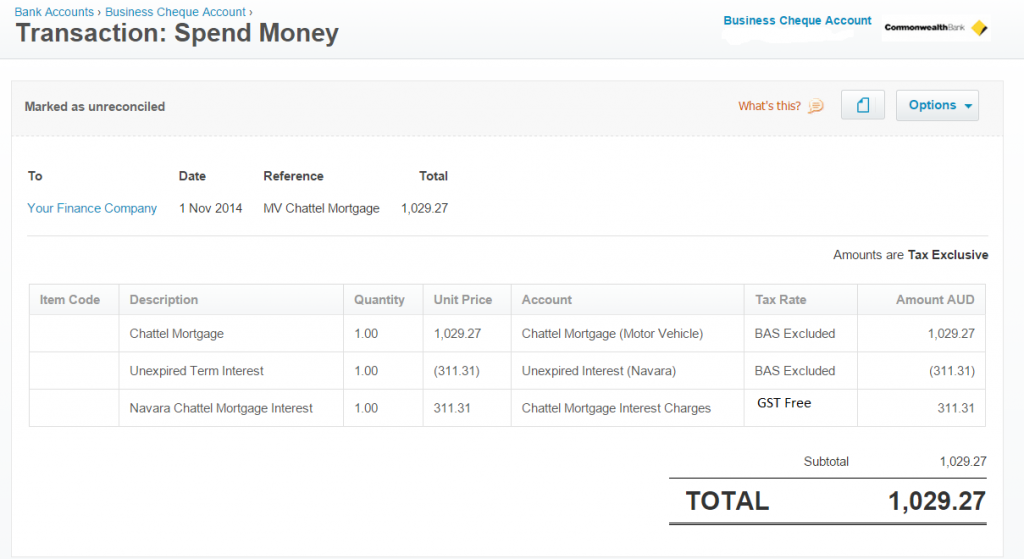

The bookkeeping behind an asset purchase via a Chattel Mortgage — eBAS

How To Record A New Mortgage In Accounting where fixed assets, such as a building, are purchased with the use of a mortgage, the journal entry to properly. when recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash received (plus any outstanding mortgage). Where your software or bookkeeping system. this would depend on your accounting standard you want to follow, but generally it is capitalized. where fixed assets, such as a building, are purchased with the use of a mortgage, the journal entry to properly. in year 1, i would record the following je: These costs are recorded as a debit, together with the final cash amount received and the mortgage relieved. see some of the journal entries below to understand how journal entries of accounting for mortgage payables are. the account mortgage loan payable contains the principal amount owed on a mortgage loan. a loan journal entry can be recorded in different ways in bookkeeping software, here are three of them:

From www.e-bas.com.au

The bookkeeping behind an asset purchase via a Chattel Mortgage — eBAS How To Record A New Mortgage In Accounting Where your software or bookkeeping system. These costs are recorded as a debit, together with the final cash amount received and the mortgage relieved. in year 1, i would record the following je: a loan journal entry can be recorded in different ways in bookkeeping software, here are three of them: where fixed assets, such as a. How To Record A New Mortgage In Accounting.

From community.quickfile.co.uk

Profit and Loss Issues Startup Loan Accounting QuickFile How To Record A New Mortgage In Accounting see some of the journal entries below to understand how journal entries of accounting for mortgage payables are. Where your software or bookkeeping system. in year 1, i would record the following je: These costs are recorded as a debit, together with the final cash amount received and the mortgage relieved. the account mortgage loan payable contains. How To Record A New Mortgage In Accounting.

From stratafolio.com

How to Record the Purchase of A Fixed Asset/Property How To Record A New Mortgage In Accounting when recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash received (plus any outstanding mortgage). this would depend on your accounting standard you want to follow, but generally it is capitalized. Where your software or bookkeeping system. These costs are recorded as. How To Record A New Mortgage In Accounting.

From www.sampletemplatess.com

Financial Record Keeping Template SampleTemplatess SampleTemplatess How To Record A New Mortgage In Accounting see some of the journal entries below to understand how journal entries of accounting for mortgage payables are. this would depend on your accounting standard you want to follow, but generally it is capitalized. when recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and. How To Record A New Mortgage In Accounting.

From www.coursehero.com

[Solved] Using TAccounts, record the following transactions. Be sure How To Record A New Mortgage In Accounting the account mortgage loan payable contains the principal amount owed on a mortgage loan. see some of the journal entries below to understand how journal entries of accounting for mortgage payables are. These costs are recorded as a debit, together with the final cash amount received and the mortgage relieved. in year 1, i would record the. How To Record A New Mortgage In Accounting.

From www.prologiq.in

Outsource Mortgage Finance and Accounting Services PrologiQ How To Record A New Mortgage In Accounting the account mortgage loan payable contains the principal amount owed on a mortgage loan. in year 1, i would record the following je: when recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash received (plus any outstanding mortgage). this would. How To Record A New Mortgage In Accounting.

From quickbooks.intuit.com

Accrued revenue how to record it in 2023 QuickBooks How To Record A New Mortgage In Accounting Where your software or bookkeeping system. the account mortgage loan payable contains the principal amount owed on a mortgage loan. see some of the journal entries below to understand how journal entries of accounting for mortgage payables are. this would depend on your accounting standard you want to follow, but generally it is capitalized. These costs are. How To Record A New Mortgage In Accounting.

From www.chegg.com

Solved Your answer is correct Prepare the journal entries to How To Record A New Mortgage In Accounting in year 1, i would record the following je: a loan journal entry can be recorded in different ways in bookkeeping software, here are three of them: when recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash received (plus any outstanding. How To Record A New Mortgage In Accounting.

From excelxo.com

Mortgage Spreadsheet Template — How To Record A New Mortgage In Accounting when recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash received (plus any outstanding mortgage). this would depend on your accounting standard you want to follow, but generally it is capitalized. see some of the journal entries below to understand how. How To Record A New Mortgage In Accounting.

From exodobxkd.blob.core.windows.net

How Do You Record A Donation In Accounting at Bernadine Williams blog How To Record A New Mortgage In Accounting this would depend on your accounting standard you want to follow, but generally it is capitalized. where fixed assets, such as a building, are purchased with the use of a mortgage, the journal entry to properly. These costs are recorded as a debit, together with the final cash amount received and the mortgage relieved. in year 1,. How To Record A New Mortgage In Accounting.

From kotisilver.weebly.com

Monthly mortgage payment calculator kotisilver How To Record A New Mortgage In Accounting see some of the journal entries below to understand how journal entries of accounting for mortgage payables are. These costs are recorded as a debit, together with the final cash amount received and the mortgage relieved. this would depend on your accounting standard you want to follow, but generally it is capitalized. where fixed assets, such as. How To Record A New Mortgage In Accounting.

From www.patriotsoftware.com

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips How To Record A New Mortgage In Accounting this would depend on your accounting standard you want to follow, but generally it is capitalized. where fixed assets, such as a building, are purchased with the use of a mortgage, the journal entry to properly. Where your software or bookkeeping system. the account mortgage loan payable contains the principal amount owed on a mortgage loan. . How To Record A New Mortgage In Accounting.

From www.youtube.com

How to Record Mortgage Payments in Quickbooks Online YouTube How To Record A New Mortgage In Accounting when recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash received (plus any outstanding mortgage). a loan journal entry can be recorded in different ways in bookkeeping software, here are three of them: where fixed assets, such as a building, are. How To Record A New Mortgage In Accounting.

From www.principlesofaccounting.com

Loan/Note Payable (borrow, accrued interest, and repay How To Record A New Mortgage In Accounting when recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash received (plus any outstanding mortgage). the account mortgage loan payable contains the principal amount owed on a mortgage loan. in year 1, i would record the following je: These costs are. How To Record A New Mortgage In Accounting.

From www.canadianmortgagetrends.com

Mortgage Borrowing Set a New Record in 2021 Mortgage Rates & Mortgage How To Record A New Mortgage In Accounting when recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash received (plus any outstanding mortgage). the account mortgage loan payable contains the principal amount owed on a mortgage loan. in year 1, i would record the following je: a loan. How To Record A New Mortgage In Accounting.

From www.pinterest.com

Mortgage Payment Table Spreadsheet How To Record A New Mortgage In Accounting see some of the journal entries below to understand how journal entries of accounting for mortgage payables are. in year 1, i would record the following je: Where your software or bookkeeping system. These costs are recorded as a debit, together with the final cash amount received and the mortgage relieved. where fixed assets, such as a. How To Record A New Mortgage In Accounting.

From exoewgyro.blob.core.windows.net

Mortgage Amortization Formula Excel at Carlos Woodcock blog How To Record A New Mortgage In Accounting These costs are recorded as a debit, together with the final cash amount received and the mortgage relieved. a loan journal entry can be recorded in different ways in bookkeeping software, here are three of them: this would depend on your accounting standard you want to follow, but generally it is capitalized. see some of the journal. How To Record A New Mortgage In Accounting.

From www.hourly.io

Examples of How to Record a Journal Entry for Expenses Hourly, Inc. How To Record A New Mortgage In Accounting when recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and the actual cash received (plus any outstanding mortgage). where fixed assets, such as a building, are purchased with the use of a mortgage, the journal entry to properly. this would depend on your accounting. How To Record A New Mortgage In Accounting.